W O R K S H O P

RETIREMENT PLANNING WITH CPF AS THE FOUNDATION

This full-day workshop is specially designed for Financial Advisors aiming to penetrate Singapore's retirement market. With this class, you will get to fully understand CPF - the Basic Financial Plan of Singaporeans.

You will also get to access a one of a kind projection tool. This CPF Projection Spreadsheet will help you to rope in clients and close bigger, better cases as you help them construct their very own retirement plan.

WHAT WILL YOU LEARN?

Practical hands-on session on how to use the CPF Projection Spreadsheet to service and acquire new clients

Interpret the projection to help clients appreciate their CPF status in relation to their Retirement plans

Learn the possible solutions to balance client’s projected retirement fund against fund required to meet client’s retirement lifestyle

Classes in 2020: Each workshop consists of 3 x 3 hrs session + 1 x 2 hrs follow up session

(Note: You can also email to arrange for an exclusive session)

WORKSHOP SCHEDULE

Jun 2020

(Not Payable with SkillsFuture Credit)

10, 11, 12 Jun (3 sessions of 3 hours each)

26 Jun (1 session of 2 hours of follow up session)

Jul 2020

(Not Payable with SkillsFuture Credit)

08, 09, 10 Jul (3 sessions of 3 hours each)

24 Jul (1 session of 2 hours of follow up session)

Click the above SIGN UP NOW to register for the above Workshop

Time: All session starts at 10 am

Venue: Online via ZOOM

SESSION ONE

Topic: Understanding Retirement Planning in Singapore

- What is retirement planning and why is it important?

- When should one start his/her retirement planning?

- Important questions in personal retirement planning

- How much is required?

- What are the potential sources of retirement income?

- How to go about doing up a retirement plan?

Topic: Understanding CPF - Your Basic Retirement Plan

- Acquire a general understanding of CPF as the Basic Retirement Plan for most Singaporeans

- Special highlights

- CPF Contribution, Basic Healthcare Sum & Topping Up

- CPF Contribution Cap and SRS

- Additional Interest on the First $60k Combined CPF Balances

- Which Retirement Sum should I set aside at 55?

SESSION TWO

Topic: Understanding CPF - Your Basic Retirement Plan (Cont...)

- CPF Life Scheme

- Which option is more suitable – Standard, Basic or Escalating?

Topic: Mastering the 5 Stages of Retirement Planning

- Practical hands-on session on how to use the Personalized Retirement Cashflow Spreadsheet to service and acquire new clients with actual case studies

- Stage 1: Learn how to generate and present CPF Report at 55 with basic 3 + 2 + 2 Fact Finds.

- Stage 2: Learn how to assist the client in determining a realistic Retirement Lifestyle Budget with Inflation and determine whether it can be fully supported with CPF alone.

- Stage 3: Learn to identify from the client's current financial portfolio (insurance, savings, investment plans, rental income or business income) possible funds that can be used for Retirement funding.

- Stage 4: Factoring possible funds from Stage 3 together with CPF, learn to determine whether the client’s current Retirement plan is sufficient to support his Retirement Lifestyle.

- Stage 5: Assuming Stage 4 cannot be supported, learn how to recommend suitable Retirement product(s) to meet the shortfall.

- Note: All the above steps come with scripts for effective delivery

SESSION THREE

Topic: Case Study on Real-Life Cases

- A practical hands-on session to master the use of the Retirement Cash Flow Projection Spreadsheet via real case studies.

- At least two below 55 case studies

- At least two above 55 case studies

- Use of CPF Life Estimator

- Extraction of CPF Annual Statement

- Do a full case study with the recommended solution

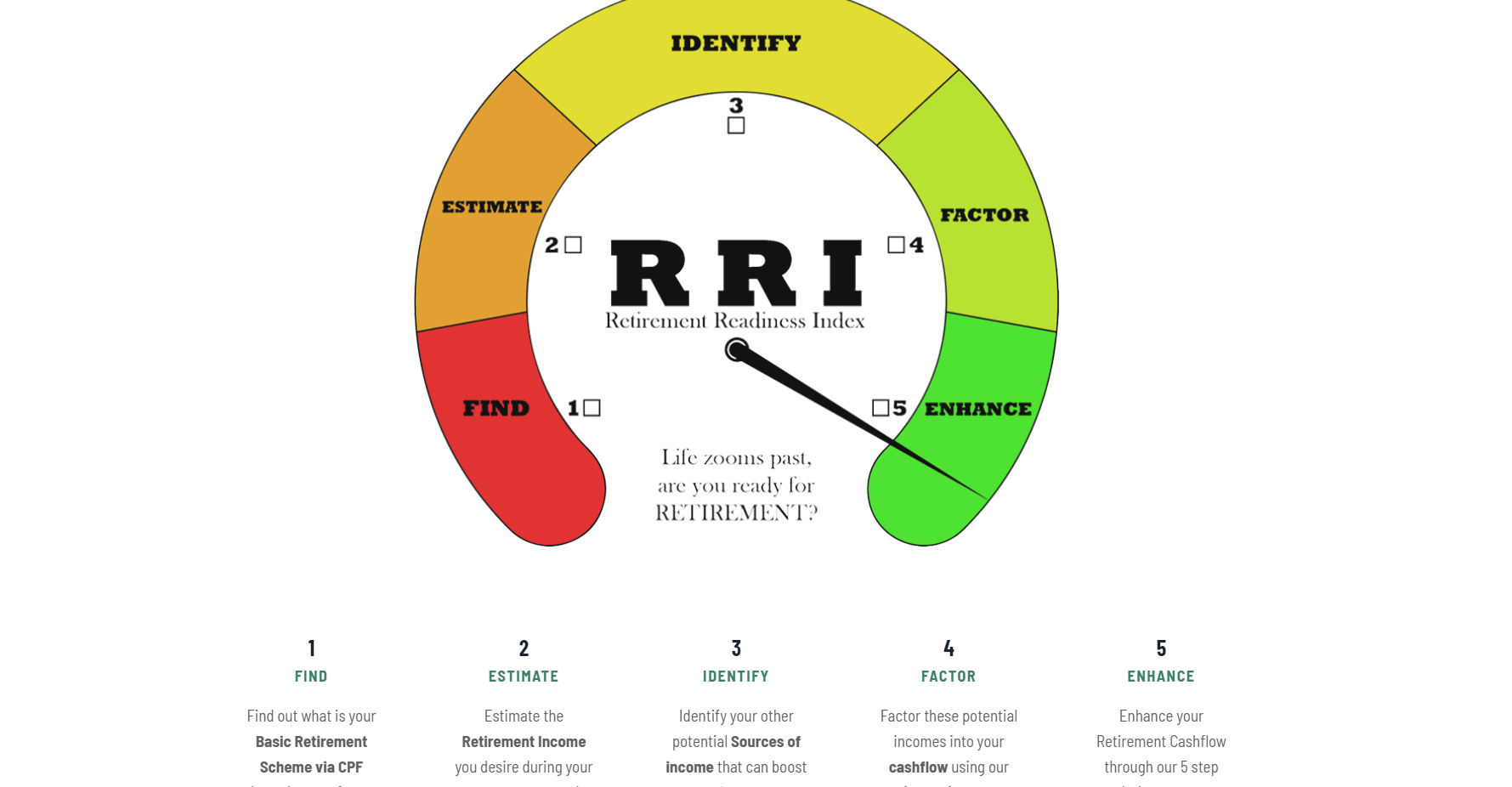

RRI (RETIREMENT READINESS INDEX)

The Retirement Readiness Index is an estimate of how your retirement will be like financially. By using your current portfolio with our CPF projection software, we can work out the CPF payout you will receive during your retirement years as well as the lump sum of money you may withdraw from CPF. With this information, we can determine if your current retirement plan will be able to support your desired retirement lifestyle.